An Inconvenient Truth: How Tesla Became A Trillion-Dollar Company

Astonishing story about the rise of green technologies

How Tesla Became a Trillion-Dollar Company. After the news that Hertz decided to buy 100 000 Tesla cars for more than $4 billion, Tesla capitalization has already increased almost by $200 billion. I am not talking about the market irrationality anymore, but I feel a bit curious. Hertz has recently emerged from bankruptcy and has not received any wholesale discount from Musk. How and why Hertz is going to buy such expensive cars? The answer is simple — with taxpayers’ money.

Apparently, the White House has recently passed the Budget Reconciliation Bill, which would cost $1.75 trillion for US citizens. There are plenty of benefits for the so-called ‘clean energy’ in it, particularly, 30% of tax deductions for ‘qualified commercial electric vehicles’. It means that after buying Tesla cars Hertz will receive $1.26 billion of tax cashback. In fact, there are also some benefits for the installing of electric vehicle charging stations. Hertz has already announced plans to make thousands of charging stations.

It is important to mention that common people have also an access to tax benefits and the compensation limits are increased from $7500 to $12 500. As an example, instead of paying $15 000 income tax you may buy Tesla Model S and pay just $2500. It is like a pretty bonus from Tesla or a good discount on electric vehicles. Seems to be a good motivation to refuse from internal-combustion engines, doesn’t it?

Moreover, Tesla also gets ZEV credits and other benefits for manufacturing its products. That way, the US government restructures the automotive market literally by hands. Do you know what I find the most interesting in this story? The fact that the new bill was published on October, 28th but Hertz announced buying of Tesla cars on October, 25th. As you can understand, the decision was made much earlier.

Now I would like to tell you about one very interesting character in the US establishment named Al Gore. This is the former US Vice President under Clinton, the presidential candidate in 2000 and the Nobel Peace Prize winner for the film An Inconvenient Truth (2006) about global warming.

His film and book have actually became the foundation for modern climate policy and the public demand for renewable energy sources. One should notice keep in mind that along with the awareness of internal concern for the ecology Al Gore was one of the first who realized the commercial potential in projects devoted to the protection of the environment.

Two years before ‘An Inconvenient Truth’ Al Gore together with Goldman Sachs Chief Asset Manager David Blood has run a new investment company Generation Investment Management. As a result, they both defined terms sustainable investing and ESG.

The former presidential candidate, as we could see, was very good at technology and finance. In 2007, he was suddenly invited to become a partner in Kleiner Perkins — one of the oldest and largest venture funds of Silicone Valley. John Doerr, one of Kleiner Perkins chief partners, joined the advisory board of Generation Investment Management.

J. Doerr, as Al Gore, stood for the innovations in clean energy to struggle with climate change. On the TED conference in 2007, he quoted his daughter “your generation created this problem, you better fix it”. That reminds me on Greta Thunberg’s words which would be told later. So that J. Doerr and Al Gore had a similar vision of the future and the month after mentioned partners’ rotation Kleiner Perkins fund invested into Silver Spring Networks.

By great coincidence, this deal happened a year before the US Department of Energy had announced a $3.4 billion grant program for smart grid developers. In fact, $560 million of this amount was spent to utilities serviced by Silver Spring Networks, which works exactly with smart grids. 6 years later Silver Spring Networks successfully entered an IPO.

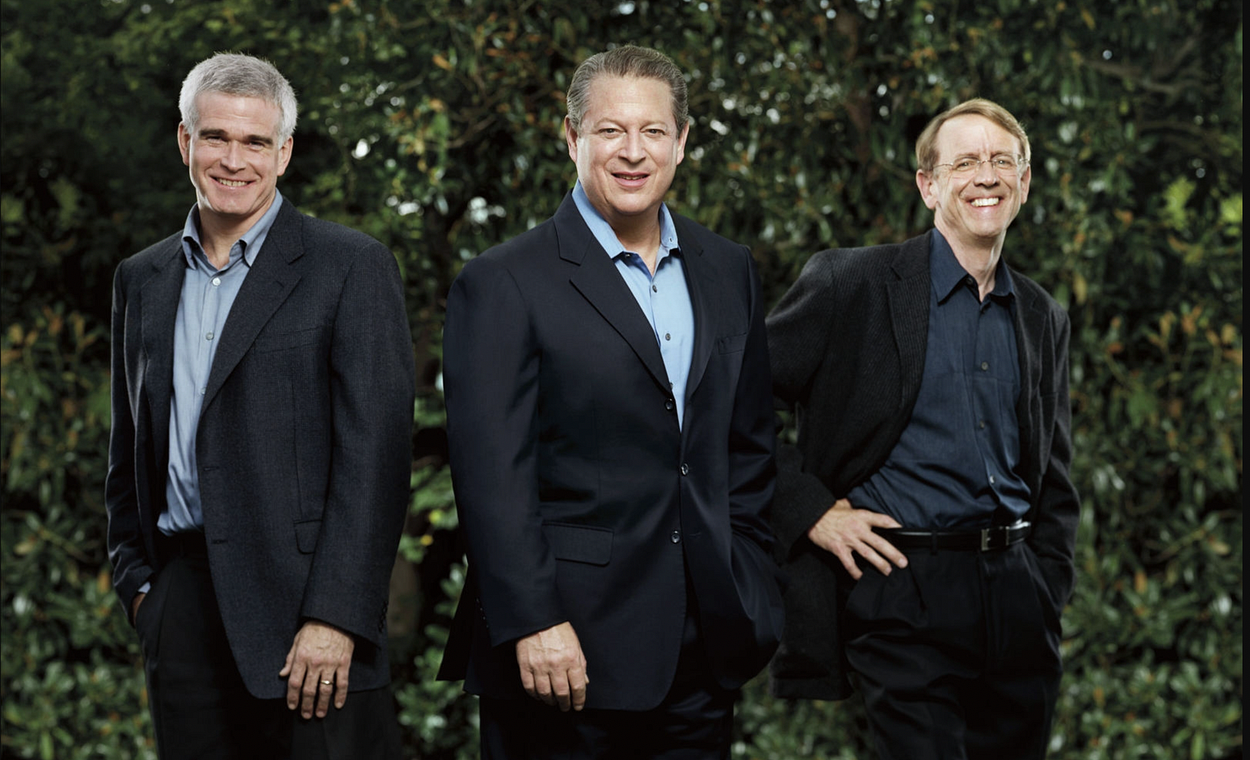

David Blood, Al Gore and John Doerr

Luck literally pursued Kleiner Perkins. In 2008, the fund invested tens of millions dollars in a start-up hybrid cars manufacturer Fisker Automotive. After that, in September 2009, the company received a low-interest $529 million loan under the Advanced Technology Vehicle Manufacturing (ATVM) direct loan program from the same US Department of Energy.

Congress passed ATVM in 2007 after a drop in sales in the big three (General Motors, Ford, and Chrysler). The volume of the borrowed capital was $25 billion. The goal of the program was to help the US auto industry to reduce fuel costs because Americans were tend to choose more fuel-efficient Japanese cars. That is, the problem devoted not to ecology issues, but much more to fuel saving.

Again, ATVM passed in 2007, but the allocation of funds began only 2 years later on a competitive basis. In February 2009, 8 months before the government loan to Fisker Automotive, John Doerr of Kleiner Perkins became a member of the Presidential Economic Recovery Advisory Council. The funny thing is that Fisker did not even have manufacturing facilities in the USA and the assembly of their Karma models took place in Finland.

The Obama-Biden administration appointed a venture capitalist from Kleiner Perkins as a member of an economic advisory board. They also signed a government loan for help American automotive industry to a company (without any manufacturing capacity in the United States) that Kleiner Perkins has invested in.

That trick was obviously noticed by the public. Some companies have sued the Department of Energy, Mitt Romney even called on Congress to open an investigation into the loan to Fisker Automotive, pointing out that its investors included Al Gore, who sponsored Obama’s presidential campaign. Nevertheless, somehow all that worries dwindled away.

Fisker’s plans to start the manufacture at a closed GM plant in Delaware at the expense of a government loan, which GM itself did not receive, deserved special attention. These plans caused some questions among local residents, and then current Vice President Joe Biden, who served as Senator from Delaware from 1973 to 2009, assured people that the budget money for Fisker would be paid off, and the company will eventually return “billions-billions” dollars to everyone.

Running ahead, the budget money didn’t return to taxpayers because Fisker went bankrupt in 2013. From the bankruptcy documents, which fell into the journalists’ hands only 7 years later, it turned out that Hunter Biden (Joe Biden’s son) was an investor of Fisker. However, this fact also faded into oblivion without preventing Biden from gaining 58.8% of the votes in Delaware during the 2020 presidential election.

Let us turn back to Tesla. Only $8.4 billion were allocated from the $25 billion program of help to the American auto industry. Only 5 companies received money, although 108 applications were received. Almost $6 billion went to Ford with a democratically oriented management, $1.5 billion were given to Nissan, about half billion — to Fisker and Tesla and, finally, $50 million came to a less known VPG company.

Surprisingly, the credit limit has not been exhausted, large manufacturers like General Motors or Chrysler did not receive money, but two unprofitable startups from California, selling several hundred cars each, did. We already know the main lobbyists of Fisker — they are Al Gore and John Doerr, who invested in Fisker through Kleiner Perkins. But were they acquainted with Elon Musk? A brief search immediately gave a positive answer to that question.

In 2013, Al Gore, while talking about his new Tesla S in an interview to Yahoo Finance, called Elon Musk his friend. More than that, his son Al Gore III has been in charge of Policy & Business Development at Tesla since 2015. After learning that I immediately went to have a look at the Generation Investment Management profile on CB Insights. It turned out that the Gore fund had invested in Musk’s SolarCity in 2011 and Gore III worked there as a Policy Officer.

Then in 2016, Tesla acquired SolarCity. An unprofitable service company that didn’t even produce solar panels was taken over for a suspiciously large amount of money. Recently it turned out that Elon Musk has faced a $9.4 billion fine for this deal, although the final court decision had not been made yet. It is important that after the takeover in 2018, Al Gore became suddenly nominated for the post of chairman of the Tesla board of directors.

SolarCity’s valuation was really high

Al Gore rejected that offer but I did not doubt more about his close connection with Tesla. At the same time, I was interested in their possible contacts before receiving the lobbied state subsidies of 2009. That’s why I decided to change the angle and check whether Tesla has a relationship with Kleiner Perkins. Then it turned out that Elon Musk had been friends with John Doerr for a very long time.

In 2006, when Tesla looked for money in round С, Kleiner Perkins fund offered $50 million, while VantagePoint offered $70 million. Despite the huge difference in bids, Musk wanted to strike a deal with Kleiner Perkins but on the condition that John Doerr would sit on the board of directors. Unfortunately, J. Doerr had many other obligations and was forced to refuse. That’s why Musk chose VantagePoint, as he told in an interview.

I went on and learned that the vice president of Tesla in 2006–2017 was Diarmuid O’Connell. As I remember, he was responsible for national security issues under former Secretary of State Colin Powell. He also spoke about Iraq chemical weapons and showed test tube to legitimize the military invasion of Iraq at the UN in 2003.

I wondered how he appeared in that story. However, I didn’t have to look for an answer for a long time, so let us meet Colin Powell, a member of the advisory board of Kleiner Perkins, a strategic partner of the fund in 2005.

There was no direct investment from the fund in the company, nevertheless it seems that there was another strong connection between Kleiner Perkins and Tesla. Is Al Gore really not a government subsidy beneficiary for Tesla? My confirmation bias did not allow this thought to get along in my head. Searching for keywords, I came across publications in Yahoo Finance and Insider Monkey. The articles mentioned Gore’s earlier investment in Tesla.

Keeping in mind that the journalists could simply make a mistake, I began to study which funds were invested in Tesla at earlier stages and whether Al Gore was involved. Finally, I came across an interview with the managing partner of Capricorn Investment Group on the blog of the Japanese financial holding Nomura. He said that Capricorn financed the filming of ‘An Inconvenient Truth’ movie.

Capricorn was founded by Jeffrey Skoll, the former eBay president and billionaire. The fund invested in Tesla together with SpaceX at early stages. Mr Gore brought in $35 million! Can you imagine? “That’s a big wad of cash for someone who reported barely $2 million in assets in 2000, when his job as vice president came to an end”, as the New York Times wrote in 2008.

As a result, Al Gore was the direct beneficiary of providing state loans under the ATVM program for Fisker Automotive and Tesla Motors, in which he owned shares through venture funds Kleiner Perkins and Capricorn Investment Group.

When I proved it, I wanted to learn more about Al Gore’s bio. It has been revealed that after losing the election, in 2001, he became a vice president of Metropolitan West Financial — a company with more than $65 billion in assets under management. The company was managed by former heads of Drexel Burnham Lambert. That was a bankrupt investment bank, which history was very similar to Lehman Brothers.

The same year Mr Gore also joined the Google Advisory Board, in which he invested together with Kleiner Perkins in 1999. Probably that was the time when he met John Doerr. Then, in 2003, the former US presidential candidate became a member of Apple’s board of directors. In addition, the founders of Google were also early investors in Tesla.

It is clear that Albert Gore had many connections in political and financial communities. In 2006, he started a charitable organization The Alliance for Climate Protection. The company launched a $300 million (sic!) ad campaign to mobilize Americans to reduce greenhouse gas emissions immediately. As a result, an “inconvenient truth” was told to everyone.

In 2009, Gore appeared before the United States Senate Committee on Foreign Relations to support Obama’s economic recovery plan. Then the government had passed the Recovery and Reinvestment Act, which included an $80 billion stimulus package to promote green energy initiatives. Newspapers called the bill the “biggest energy bill in history”.

The person who owns stakes in Tesla and Fisker first knocks out government loans and then pushes a law according to which manufacturers of electric vehicles should pay fewer taxes, and buyers of electric vehicles should receive tax deductions. Can you imagine?

Surely, Al Gore was not the only one who acted in this process. In 2006, Nick Pritzker, the brother of Hyatt founder, invested in Tesla. His niece Penny Pritzker became the 38th US Secretary of Commerce in Barack Obama’s cabinet, and his nephew was the Governor of Illinois. In general, Pritzker is one of the richest families in the US.

Among of early investors in Tesla there is Steve Westley, a politician and businessman. He has already joined the company’s board of directors in 2007. More than that, during the 2008 presidential election, Westley acted as a co-chairman of California’s Obama for America campaign. Currently, he is a member of the US Department of Energy advisory board.

Al Gore, John Doerr, Nick Pritzker, Steve Westley, Elon Musk, Sergey Brin, Larry Page — all of them were so-called donors to the Obama campaign. I mentioned only the names from the public access. Let me remind that these people are only mentioned in the context of the Tesla story while the whole green initiative and the Recovery and Reinvestment Act affects a much larger number of companies and investors.

The rapid development of electric vehicle companies is taking place in a distorted market environment. Their commercial success is mainly driven by government incentives unavailable for ICV cars manufacturers.

The US government is literally restructuring the auto market by hands. In that case the active discussions about climate change and greenhouse gas emissions could probably be nothing more than a part of a program to reallocate money in the US establishment.

At the same time, I totally understand that all of the above can also be interpreted as a good initiative of a group of fabulously rich and therefore more enlightened people who care about the world’s population. To tell the truth, entrepreneurship always carries a creative function, so why should they avoid making money on a good deed?

However, the question remains whether this is really a good things, because there is no full consensus in the scientific community regarding the general belief in the environmental friendliness of electric vehicles.