Conversation with Bloomberg's Former Head of Trading on the Future of Humans in the Trading Industry

Rob Shapiro’s deep interest in Wall Street started as a graduate from the University of Michigan Ross School of Business. His experiences on the street were bountiful; he was the COO of Global Trade at Morgan Stanley and also took positions later on at Bloomberg as Global Head of Trading and Execution Consulting and Global Head of Operational Risk. So, what is Shapiro’s take on human trading on Wall Street? Simple: it is going to end and it is not a matter of if, it is a matter of when.

An often overlooked downside to buy-side trading that Shapiro mentions is the operating costs of running trading desks. Bloomberg machines, which are distributed to each trader, cost $24,000 a year. The traders that use those machines have lofty salaries and commission payments, and the spaces needed to occupy these desks require rent payments. The overarching reason why human trading will end, though, is because there is no metric to measure how good a buy-side trader is at their job. How much value a trader creates, as well as whether or not they are good at what they do, cannot be objectively measured. This currently comes as a fault; when trading desks were first set up, the mentality was that you either made money for the firm, which was good, or you lost money, which, of course, got you fired. So, with the current state of the trading industry defined – huge operating costs for these human traders that have no measure of return on investment – there must be new innovation to revolutionize trading.

Bloomberg's very expensive terminal

Shapiro took it upon himself to try to metricize the performance of a trader at Morgan Stanley by developing TPM (trade performance metric), a model that establishes two qualities that recognize a skilled trader: the ability to manage momentum, which is capitalizing on the rate of acceleration of a security’s price or volume, and being able to manage liquidity effectively, which is acquiring stock at the minimal cost. Shapiro says the two factors are the “bones of the math,” and when applied to AI and algo-trading software, they can create a veryeffective trader.

Automation is solving many problems, and in today’s era of trading, automation would be the solution for sub-optimal execution and risk management issues. Machines are completely unbiased and do not account for human emotion. Additionally, the worst financial events come from human traders making mistakes and trying to cover it up, which is something a machine would not do. The automation process has already started; JP Morgan and Goldman Sachs have already fully automated their sell side equities trading desks, cutting staff down from 5000 people to only 3. If the sell side is already being automated, it is only a matter of time before the buy side will follow.

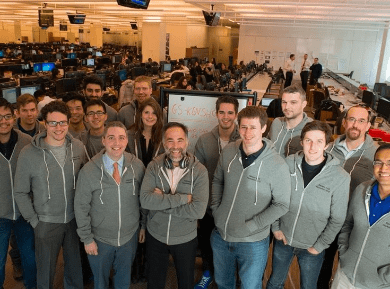

Goldman Sachs' new and growing quant department

In today’s age, everything is becoming stored as data; 2.5 quintillion bytes of data are being stored every day. Machines analyze and crunch data at rates far faster than humans, and therefore can create a much more accurate evaluation. Say, for example, heads of large companies hold a conference, and analysts attend the event.

While the executives are speaking, the analysts are listening, trying to pick out anything proprietary and updating their excel models. If an analyst finds something noteworthy, the next day, they will pitch to their bosses toinvest in “x” stock. If the bosses agree, the next day, their company will take positions in “x” stock. However, every word that is said at that conference is being recorded and pushed out on livestreams. This information is being processed by machines and redigitalized into a consumable format for the algorithms to then analyze. Within seconds, an algorithm can pick up that stock “x” is undervalued and buy it within minutes. That means that the human traders are two days late and the market is already priced in.

Algo trading has already surpassed the capabilities of human trading, and it will only continue to evolve. Gordon Moore, the founder of Intel, created the property Moore’s Law, where computer processing speeds double every 18-24 months. With these accelerating returns, Shapiro believes that it is only a matter of time before human traders become phased out and AI and machines become the future of the trading industry

Interview with NASA Astronaut Scott Kelly: An American Hero

13 Questions With General David Petraeus

Why Choose Machine Learning Over A Traditional Financial Advisor?

Deep Fakes: Terror In A Data Driven World

Nuclear Submarines: A 7,000 Lb Swiss Watch

Interview with the Inventor of Amazon's Alexa

Ai Can Write Its Own Computer Program

On Black Holes: Gateway to Another Dimension, or Ghosts of Stars’ Pasts?

Tesla's Augmented Reality & Virtual Reality Founder Tyler Lindell Opens Up

Supersonic Travel: The Future of Aviation

Lockheed Martin Confirms the SR-72 – Son of Blackbird Will Reach Anywhere in the World in One Hour

Shedding Light on Dark Matter: Using Machine Learning to Unravel Physics’ Hardest Questions

Aquaponics: How Advanced Technology Grows Vegetables In The Desert

The Perfect Beer: Using Artificial Intelligence to Personalize Goods

The World Cup Does Not Have a Lasting Positive Impact on Hosting Countries

The Implications of Machine Learning on Condensed Matter Physics & Quantum Computing

Written by Yves Chen, Edited by Rachel Weissman & Alexander Fleis