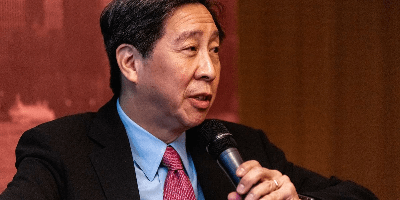

Eric T Young, Compliance Legend, ex Compliance Chief of JPMorgan, BNP Paribas, CIBC, RBS Bank, S&P Global Ratings & Fordham Law Professor

Eric T Young specializes in re-engineering Compliance & Ethics programs to enable regulatory health / business growth. • Eric teaches Corporate Compliance at the Fordham University School of Law in New York City. • He is also Founder and CEO of Young Enterprises LLC, an enterprise compliance leadership forum. He is also an Advisory Board member of Unified Compliance Framework (UCF), a compliance technology firm, and The World Food Bank, which provides an innovative investment platform that empowers stakeholders across sectors and creates efficiencies in food production and finance for developing nations. • He has 40+ years’ regulatory, financial crimes and Chief Compliance and Ethics Officer (CCO) experience with the Fed, JP Morgan, GE (handling FCPA, KYC, capital markets issues over GE’s healthcare, energy, other industrial and GE Capital businesses), S&P Global Ratings, and four foreign banks including UBS, and most recently as CCO of BNP Paribas Americas (the large French bank) until he retired in February 2020. • He therefore brings deep regulatory, financial services, and industrial compliance experience at the enterprise, regional and divisional levels • He builds and sustains enterprise compliance programs aligned with the US DoJ Sentencing Guidelines, Fed, NY State, UK Financial Conduct Authority, FCPA and Basel standards. • Eric graduated from Columbia University at the age of 20, with a degree in Economics and has securities licenses with FINRA and ACAMS-certified (exp 12/20). • He is a frequent speaker/author, and featured in the American Banker, Wall Street Journal, Forbes, and Reuters. • He is presently writing a book, entitled ”Declaration of Independence” about the strategic partnership between the CCO and the independent board of directors to hold management more accountable.