Future of CPU Market Share & AMD

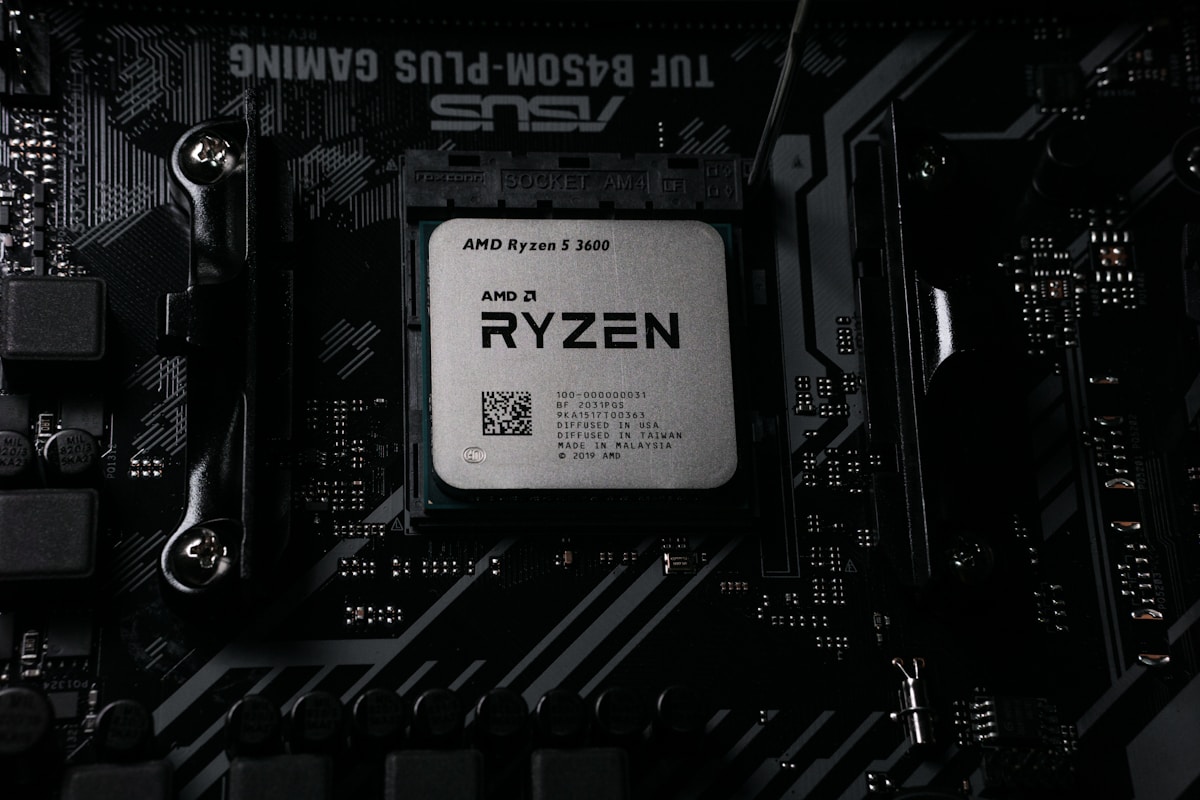

Advanced Micro Devices (AMD) has recently made headlines for overtaking a large portion of Intel’s CPU market share.

AMD outsourced its semiconductor production to companies like The Taiwan Semiconductor Manufacturing Corporation and it has allowed AMD to focus on what they do best. Now, to further their recent growth, AMD is attempting to acquire Xilinx, pending US & Chinese government approval, on July 1st, AMD was granted unconditional approval by the EU.

The acquisition of Xilinx is one that will allow AMD to quickly penetrate and be a leading player in the field-programmable gate array (FPGA) market, a market that is expected to grow at a compounded annual growth rate (CAGR) of 7.6% by 2026. The acquisition of Xilinx comes with 4,400 patents on innovative technology. Many of these are necessary for the success of data centers.

early age AMD processor

The main benefits of FPGA’s lie in artificial intelligence applications. Although GPU’s made machine learning possible simply because of their sheer processing power, FPGA’s are now able to process at higher rates with reduced costs. The additional benefit in machine learning lies in the ability to update the logic and load in new neural networks. This is not possible in standard application-specific integrated circuits. For the aforementioned reasons, AMD valued Xilinx at $35 billion.

The purchase price of $35 billion may seem excessive for a company that had annual sales of $3.1 billion in 2020, but this price is immediately discounted by the $3 billion dollars in cash holdings that Xilinx has. In addition to the high cash balance, Xilinx has a debt-to-equity ratio that is unmatched by companies exhibiting similar growth. Xilinx has been growing at a CAGR of 6% since 2017 and has a debt-to-equity ratio of .51. Companies such as Intel have had annual revenue growth of 5% since 2016 with similar debt-to-equity ratios, a sign that Xilinx is able to grow without being dangerously leveraged.

Since 2019, Xilinx has been able to decrease its cost of production from 31.6% of net revenue to 30.5%. This has been offset by increased investment in research and development which has been successful as their patent application rate has increased. Expanded R&D has led to decreased gross margins. Xilinx currently maintains earnings per share of $2.61 in the trailing twelve months. If this is added to AMD’s current $2.36 earnings per share it would take total EPS to $2.89. A 22% increase from prior levels. If AMD maintains the historic 30x P/E ratio, this would mean a $15 price increase from pre-announcement levels. Since the announcement, AMD has gained $14. If governmental approval is not attained, the expected drawdown could be up to $14, if not, greater.

Overall market sentiment was positive following the announcement in October 2020. The put-call options ratio prior to the announcement was approximately .6 and has since reduced to .3 in the last 90 days.

Xilinx relies on TSMC for wafer fabrication. This is what has made AMD successful thus far, and in the race against Intel for production, Xilinx has the upper hand. Intel has fallen behind as a result of fabricating its semiconductors and is now planning on outsourcing. TSMC has publicly stated that they may not have enough production capabilities to handle Intel’s traffic and this could broaden the gap in total FPGA sales.

Written by Hakil Haxhiu

Edited by Jay Devon, Jack Argiro & Jimei Shen