Nio, Xpeng, & Tesla

- What have they done to cut a piece of EV cake in China?

- What have the two Chinese brands done to catch up to Tesla?

Would you pay 21,000$ for a metal plate (about ¥150,000)? This is a common question facing a potential car buyer living in Shanghai, China.

To solve the traffic congestion in Shanghai, a private-car license plate auction started in 1986. Only after you spend several months of waiting to win an auction and buy the plate first, can you go to the DMV and get a license plate for your car.

If you live in shanghai and do not want to spend the money on a plate, which is probably worth a brand-new car, you can put on a license plate for your car in another province. Without the “Shanghai '' character initial on your plate, your car will be restricted from many regions of Shanghai during rush hours. For a local resident, this essentially equates to not owning a car.

During February 2018, in Shanghai, a new government regulation has come into the public view:

“The Measures of Shanghai Municipality on Encouraging the Purchase and Use of New-energy Vehicles” is a regulation designed to encourage the purchase and use of new-energy vehicles. It was designed to effectively promote energy conservation and emissions reduction while promoting the development of the new-energy automobile industry.

Except for the range of government subsidies rewarded to the EV buyers throughout the country. One of the most stimulating terms is that for Shanghai local residents who purchase a new-energy car, the city will issue you a new license plate for free. In other words, no more $22,000 metal plates.

With the popular trend of EV in Shanghai and the generous subsidy by the government, the market for EV in China has continued to grow. After two years of implementation, in 2020, new-energy vehicle sales this year had exceeded expectations and were expected to reach 1.3 million units, an increase of nearly 8%. There may be an even bigger surprise next year, with sales growth of new energy vehicles likely to exceed 30% to 1.8 million units in 2021.

Also, in April 2020, with the IPO of Xpeng, one of the most popular EV brands in China, the attention for Chinese EV industry was raised to a new level.

So, in this article, we will focus on the analysis of three representative and listed EV brands in China. Two are local brands, Nio and Xpeng. The other is the American brand Tesla. Let’s take a look on what Nio, Xpeng and Tesla have done to compete for the market share. For Nio and Xpeng, we will be analyzing their financial statements, sales volume, marketing strategy and other factors that may help them stand out. For Tesla, we will be researching how Elon Musk built up his brand in China and Tesla’s core strategy in general.

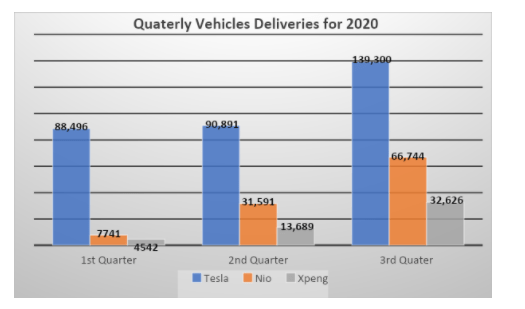

To begin with, capital markets tend to measure a company’s value by its market sales. Also, in order to get a steady stream of money, they must prove they can produce a lot. Tesla ranks the first among these three companies, far higher than Nio and Xpeng. Tesla’s Model 3 and Model S have taken a lead and delivered a huge amount.

The EC6 delivered by Nio starting in September will also give Nio an advantage over its competitors in terms of product diversification. In order to compete, Xpeng issued the new P7 model during the second half of the year. Deliveries of the Xpeng P7 model began in May, but so far, P7 model seems to be doing only so-so with direct competition with Tesla’s Model 3. Previously, Xpeng released a compact SUV, Model G3, featuring middle-to-low-end utility and price. However, the lower price hasn't led to a sale surge.

So, what have the two Chinese brands done to catch up with Tesla?

Nio:

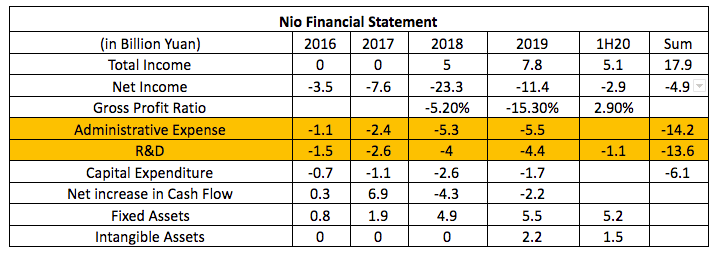

In the financial analysis of these two Chinese companies, we will focus on some important aspects, such as gross margin, profit, cash flow and financing. To find out how they distribute and invest their money, we will be analyzing more on their R&D and administrative expenses.

Based on financial statements of Nio. In the second quarter, Nio generated positive cash flow from operating activities for the first time in history. In the third quarter, Nio's gross profit margin increased to 12.9%. Nio’s success to make a profit mainly rely on the financing activity related to the Hefei government, which has been implemented in the first half of the year.

Nio dive into the EV market with the marketing slogan as "users’ enterprise". In the early stage, Nio was burning money from one launch event to another to build recognition. Meanwhile, it also concentrates many resources on R&D and marketing. Improving a series of after-sales services and hopes to create an approachable image for Nio.

In 2018 and 2019, The sales administrative expenses of Nio were 5.3 billion yuan and 5.5 billion yuan respectively. After a big expansion in 2018, the company made great efforts to streamline its sales force and reduce the scale of marketing expenditure. In 2019, it has effectively controlled the sales administrative expenses. However, the rental and depreciation expenses brought by the expansion of offline stores still maintain a rapid growth.

In 2018 and 2019, the R&D spending of Nio is 4 billion yuan and 4.4 billion yuan respectively, up to 54% and 11% compared with the same period previous year. The growth of R&D spending is mainly due to the stable growth of design and development costs caused by the successive launch of new models and the increasing number of R&D personnel each year. In 2019, the growth in the number of R&D personnel has slowed, which has brought employee compensation under control. According to Nio’s general meeting in mid-2020, Nio would keep spending about 3 billion yuan each year on R&D in the future.

In a relative optimistic valuation for Nio in the industry. Nio's share price has risen 4.5 times this year. Nio's $21 billion market value implies about 6 times of 2020 revenue, about $3.6 billion. Tesla, by contrast, is valued at $375 billion, seven times its 2020 revenue which is about $41 billion. In terms of the numbers, Nio seems to have a very promising future.

For Nio’s stock owners, they have been lucky this year. The latest news on Nio announced its latest share offering plan, indicating that Nio plans to issue 75 million American depositary shares. At the same time, the underwriters will have 30 days to purchase up to 11.2 million ADS and 86.25 million ADS from Nio. Although Nio's additional issuance of shares will have a certain impact in the short term, but in the long term, we think the impact will be diluted.

When it comes to the unique technology of Nio, one of its featured ones is battery innovation, which can separate their battery with the vehicle. Car owners can simply just drive in at Nio’s designated changing station, and within a few minutes, another fully-charged battery is replaced. In this way, it can save the car owner a significant time to charge for the battery.

Nio continues to arrange electrical changing stations, and has built 155 stations, providing users with nearly one million changing experiences of quick energy supplement each year. Nio has also been constantly building their own patent barriers and right now there are more than 3,500 patent applications worldwide.

Objectively speaking, the after-sales service of these three companies, Nio is so far better than Tesla and Xpeng, which contributes to the formation of customer stickiness. Nio has opened 167 stores nationwide, including 22 Nio Centers and 145 Nio Spaces.

Nio's sales network covers 93 cities nationwide. I personally experienced their service at one of the Nio Space in Shanghai. The place was equipped with a coffee and dessert bar, and a small library as well. Once in a while, it holds baking or other homey events, and seminars in Nio space. Providing a really comfortable and cozy environment for their consumers.

Xpeng:

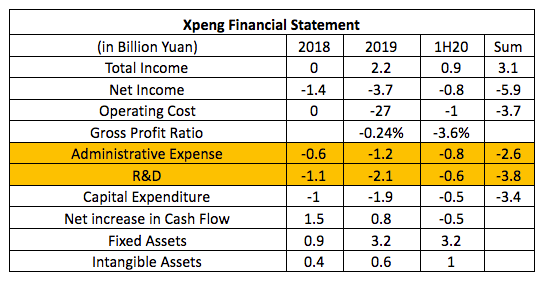

Xpeng Auto just turned its gross profit margin positive for the first time in the third quarter of 2020. For new car builders, the return to positive gross margins means that they are no longer losing money on every car they sell. Moreover, the increase of gross profit margin of Xpeng has surpassed Nio. On August 27th, Xpeng successfully completed its IPO in the United States and obtained financing from it, so there will be no financial pressure in the short term.

In 2019 and the first half of 2020, Xpeng's administrative expenses were 1.2 billion yuan and 800 million yuan, respectively. The expansion of marketing management staff, increased spending on sales and promotional activities will result in higher sales administrative expenses in 2019. Related expenses continued to increase in the first half of 2020 mainly due to P7's marketing and advertising expenses. Due to the continuing expansion of sales outlets,

the sales staff and direct store rents have kept increasing.

R&D cost and capital spending accounted for a large proportion of investment in 2018. In 2019 and the first half of 2020, Xpeng spent 2.1 billion yuan and 630 million yuan, respectively on R&D. The large expansion of R&D personnel and the promotion of new models and platforms in 2019 have led to a significant increase in R&D costs.

In the first half of 2020, sales administrative expenses rose significantly and became the largest input item, while R&D expenses and capital expenditure declined a little. By the first half of 2020, the company has 3,676 employees, 43% of whom are R&D personnel, 66% of whom are engaged in vehicle design and engineering, 17% of whom are engaged in autonomous driving and 17% of whom are engaged in intelligent operating systems.

In 2019 and the first half of 2020, Xpeng's capital expenditure is 1.9 billion yuan and 500 million yuan, respectively. Mainly used for Zhaoqing vehicle manufacturing plant construction. It is believed that with the Zhaoqing factory’s production capacity becoming to grow, the piled-up orders of the P7 model will be gradually delivered. The increase of delivery volume in the short term will also boost its share-price performance to a certain extent.

Xpeng focuses more on vehicle’s intelligent performance development, and its business model is closer to Tesla. For example, Xpeng put a huge amount of effort on autopilot. The latest Xpeng P7 is equipped with 31 sensors to enhance the sense of self-driving. In the future, it will be equipped with laser radar for supporting use, and they are ambitious to build a vision system better than Tesla. Xpeng has made a lot of breakthroughs in developing software algorithms for driving scenes using Chinese users’ characteristics and user habits data.

There is also important news about Xpeng. On the evening of August 27, the night they IPOd. One of the largest group-buying platforms, Juhuasuan, which belongs to Alibaba Group announced a subsidy of 10 billion yuan for Xpeng’s car. Each buyer can purchase one car with a 50,000-yuan subsidy.

At the same time, all models will enjoy an additional subsidy of 2,000 yuan before August 31. Overnight, Xpeng announced that the number of their online orders quickly exceeded 1,000, setting a new trading peak. But what is the concept of 1000 units?

According to the average monthly sales volume of Xpeng automobile is about 2000 units. So, with the support of Juhuasuan's 10 billion subsidy, Xpeng sold nearly half a month's sales volume in one night. The reason is that one of the major shareholders behind Xpeng is Alibaba. In addition, the founder of Xpeng Auto has an IT background and mindset, and his marketing strategy of “auto retail” has contributed to the popularity of Xpeng.

From the above analysis, it can be shown that Nio is a more promising company than Xpeng for now and its business prospects are developing in the right direction. But the stock price is ultimately determined by the value of the company. So, for long-term investors, the difference between investing in these two companies is small.

Tesla:

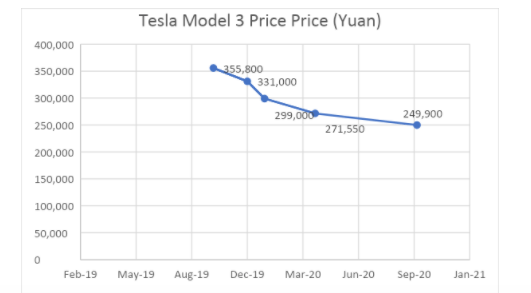

Ever since Tesla entered the Chinese market, their selling price has been dropping every year. Is that true, in order to reap the benefits of China, Elon Musk had to step down? Using Model 3 as an example, according to yearly statistics, the Tesla Model 3 has undergone several price adjustments.

When the upgraded version of the domestic Model 3 was released in October 2019, it was priced at 355,800 yuan. In January 2020, the price was adjusted to 299,000 yuan. In April 2020, in order to meet the local policy that "the price of new-energy vehicles must be below 300,000 yuan before subsidies", Tesla adjusted the price again to 271,550 yuan after subsidies. Recently, on October 1, according to Tesla's official website in China, the upgraded Model 3 made in China will only cost 249,900 yuan after subsidies.

According to Tesla's target, the localization rate of Model 3 components made in China is expected to reach 100% by the end of 2020, up from 30% at present. With the output of Shanghai Stuxnet factory increasing and the localization rate of components increasing, there is expected to be a further price adjustment space in the near future.

So, let’s take a look at what is the ambition behind Tesla's price cut.

By cutting prices, Tesla hopes to boost sales and expand the company in China. From Tesla's point of view, the expansion of the company's size and sales volume in China is the first priority. Tesla's share price has risen ten times over the past year and the company has been highly recognized by the capital market. Even this year, under the impact of Covid-19, Tesla's share price has increased more than twice the amount.

Tesla now has a market value of nearly $400 billion, which means that it exceeds the market value of General Motors, Ford, BMW, Mercedes, Volkswagen and other companies all combined. As a result, Elon Musk has become the fourth richest person in the world, with his personal wealth rising to nearly $100 billion.

In this highly competitive market, Tesla desperately needs to expand production and sales to support its valuation. Cutting prices has become a powerful tool for Tesla to expand its customer bases. Roughly estimated, China accounts for a quarter of Tesla's sales. China is certainly an important battleground for all the EV companies to cut a share.

As we all know, Tesla is not only an EV company. Tesla has seven core business strategies: connectivity, electrification, autonomous driving, battery sustainability, data business model, new mobility and organizational structure.

As the electric self-driving car revolution accelerates, Tesla is leading the way in replacing horsepower with processing power. Like Apple, Tesla's chips are designed for autonomous driving. System combined with ARM is accelerating Tesla’s self-driving process.

In the process, Tesla is developing a new currency that will revolve around how much processing power it can use to support the energy efficiency of its core powertrain components. For example, the Model 3 has a 250KWH power consumption, which is important in an urban environment because every mile saved from the battery is a vital currency.

Elon Musk's master plan is revolutionary. He is combining Tesla Energy, Tesla mobility and Tesla cars to create a giant entity. It will drive exponential growth through sustainable energy. This vision will draw consumers, and their biggest customer (cities) into the Tesla ecosystem. In this ecosystem, their car will no longer be the only product on the spotlight, but a part of a carefully crafted strategy to build a whole new network of the energy industry.

One More Thing:

Compared with Tesla, Nio and Xpeng are in a relatively weak position, but the state and local governments continue to support and subsidize the new energy automobile industry. Meanwhile, due to the worsening geopolitical crisis, and the patriotic marketing campaign to buy domestic products may make Nio and Xpeng become the beneficiaries in China.

Before the end, we want to mention that whether with or without Tesla, the challenges for domestic new energy vehicles will never end. Some common challenges are:

1. The systematic risk of Chinese concept shares still exists.

2. The rapid transformation of other traditional auto companies may regain advantages soon.

3. Other domestic EV companies are pressing in. For example, Weimar also started the IPO process, but it will not be listed in the United States.

In the future, it remains to be seen who will truly become the Chinese rival to Tesla. But their big spending on capital has shown confidence and ambition. Also, "intelligent technology defines cars" has gradually become the consensus in the industry, and intelligent research and development of automobiles is reshaping the value chain of automobiles.

As the gross profit margin of automobile hardware is further compressed in the future, the density competition of intelligent technology will become the main battlefield among the players who build automobiles in the future.

Written by Yiheng Zhang

Research and Development Director at Honeywell Raul Valdez: Supply Chain & Tesla's Autonomous Lead

Is the Tesla Cybertruck Innovative Design or Just Marketing Genius?

Robotaxis, Transportation as a Service, and Tesla’s Vision for the Future

Tesla's Augmented Reality & Virtual Reality Founder Tyler Lindell Opens Up

Industrial Control Systems: Outdated, Hackable, and in Need of an Upgrade

Is the Tesla Cybertruck Innovative Design or Just Marketing Genius?

Robotaxis, Transportation as a Service, and Tesla’s Vision for the Future

World's First Publicly Available Autonomous Driving Simulator Released!

Here’s the Coolest Looking Golf Cart You Can Drive on Real Roads

Financial data and company info are from Yahoo Finance, Sina Finance and local news.