Will The Private Equity Boom Continue?

KIRKBI, the Danish private investment company behind Lego, along with Blackstone Group and the Canadian Pension Fund CPPIB, recently bought Merlin Entertainments. Merlin is the second largest operator of amusement parks (second only to Disney). The company was owned by KIRKBI and Blackstone before it went public on the London Stock Exchange in 2013. Since then Merlin’s needs have changed; the company has doubled capital spending in the past five years. As a result, the buyers have made the huge decision for Merlin to leave the stock market. Going private will allow Merlin to invest in its expansion and develop the Legoland brand further; Merlin aims to double its Legoland network. The deal values Merlin at $6 billion and Merlin will be paid $5.75 per share, which is a 14% premium over the stock's closing price the day before the deal. This deal comes on the heels of four private equity deals this year that have eclipsed $10bn in size.

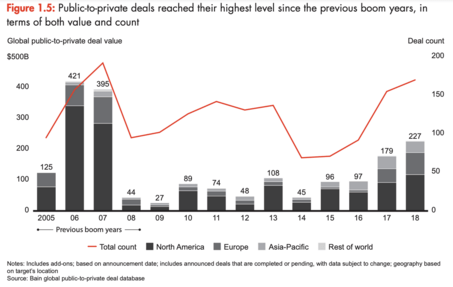

Private equity deal flow has been at an all time high for the past five years. A record 3,749 private equity funds were in the market at the start of 2019. The value of leveraged buyouts climbed to $256bn in the first six months of 2019, the second-largest first-half on record. In particular, the number of public-to-private deals, such as the Merlin deal, have soared.

This boom is surprising for a number of reasons. Firstly, it comes at a time of increasing uncertainty and market volatility. As trade tensions between the US and China wane and wax, so does investor confidence. Furthermore, many anticipate a downturn that could lead to a recession. To top it all off, global economic growth is slowing down as 70% of the global economy is expected to experience a slowdown this year.

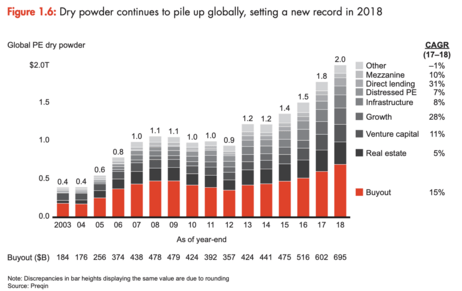

So then what is driving this boom? Preqin estimates that there is $2.44tn of dry powder, or uncalled capital, in the market that needs to be spent, and private equity firms account for 58% of all available capital. Much of this capital is focused on North America, but investments in Asia are becoming increasingly more attractive. The build-up of capital and cheap borrowing costs are driving competition amongst firms as they rush to seize the best investments.

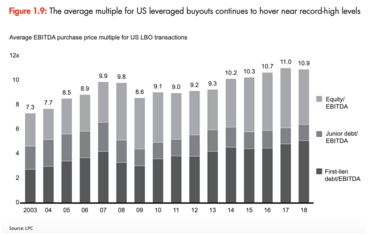

It seems like there is no end in sight as private equity groups are rushing to raise new mega funds and aim to raise close to $1tn this year. But firms like Preqin and Bain warn that this boom could come to a halt as the uncertainty in the market catches up to the private equity industry. Furthermore, fierce competition and the flood of capital has caused high pricing, which may lower returns and make investments less attractive. In addition, the multiple for leveraged buyouts in the US and Europe is reaching levels leading up to a global financial crisis. All of these are red flags for the end-of-cycle downturn.

Will the private equity boom continue? I think that depends on factors outside the industry; if trade tensions escalate or we find ourselves in the middle of a recession after the upcoming election, investors could lose confidence in American investments. Similarly, the outcome of Brexit will influence levels of investment in Europe.

To read more about the future of the private equity industry, start here: https://www.bain.com/insights/year-in-review-global-private-equity-report-2019/

Interview with NASA Astronaut Scott Kelly: An American Hero

Why Choose Machine Learning Over A Traditional Financial Advisor?

On Black Holes: Gateway to Another Dimension, or Ghosts of Stars’ Pasts?

Tesla's Augmented Reality & Virtual Reality Founder Tyler Lindell Opens Up

Supersonic Travel: The Future of Aviation

Lockheed Martin Confirms the SR-72 – Son of Blackbird Will Reach Anywhere in the World in One Hour

Shedding Light on Dark Matter: Using Machine Learning to Unravel Physics’ Hardest Questions

Interview with the Inventor of Amazon's Alexa

Aquaponics: How Advanced Technology Grows Vegetables In The Desert

The World Cup Does Not Have a Lasting Positive Impact on Hosting Countries

The Implications of Machine Learning on Condensed Matter Physics & Quantum Computing

Written by Sonakshi Dua, Edited by Jennifer Xie & Alexander Fleiss